Being a first time home buyer one of the hardest things to save for when you’re looking to buy your first home is the downpayment. Now California will offer the California Dream For All Shared Appreciation Loan that offers homebuyers up to 20% financial assistance that can be used toward a downpayment or closing cost for a home! Today we will go over some of the program details and who I think the program would or wouldn’t work for.

How Does California Dream For All Shared Appreciation Loan Work?

The California Dream For All Shared Appreciation Loan offers first-time homebuyers in California a shared appreciation loan of up to 20% of the cost of the home.

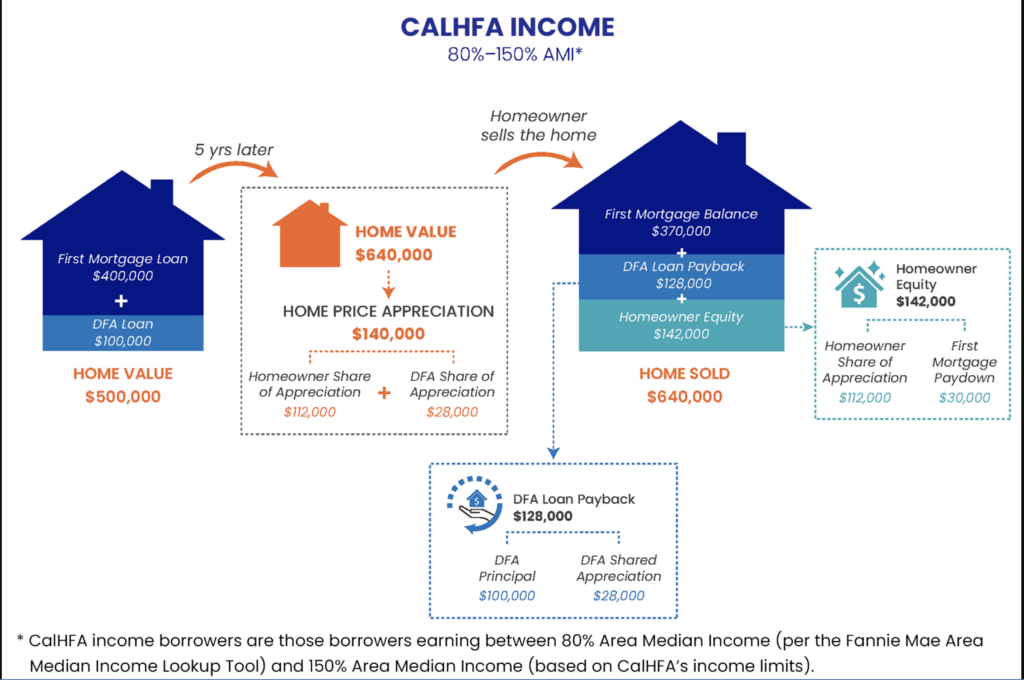

So in the example below say you plan of buying a home for $500,000. If you were able to get 20% down from this program ( $100,000) you would have a loan of $400,000 with nothing out of pocket for the down payment.

So say in 5 years your home value appreciates to $640,000 you would have $140,000 in equity. Upon sale or transfer of the home, you would repay the original down payment loan, plus a share of the appreciation in the value of the home.

So on the right side you the image below you see the homeowner decides to sell his home after 5 years. Once the home has sold the DFA ( Dream For All) program would receive $128,000 and you would receive $142,000. The rest of the funds made at during the sale of the home would be used to pay of the loan.

So Who is Eligible for the California Dream For All Shared Appreciation Loan?

Borrower Requirements

- Be a first-time homebuyer: A first-time homebuyer is defined as a borrower who has not had an ownership interest in

- any principal residence or resided in a home owned by a spouse during the past three years.

- All borrowers must occupy the property as their primary residence within sixty (60) days of closing; non-occupant co-borrowers are not allowed.

- CalHFA borrowers must complete two levels of homebuyer education counseling and obtain a certificate of completion through an eligible homebuyer counseling organization.

- Meet CalHFA income limits for this program.

- LOS ANGELES $180,000

- SAN DIEGO $211,000

*In the case of conflicting guidelines, the lender must follow the more restrictive.

Property Requirements

- Be a single-family, one-unit residence, including approved condominium/PUDs

- Guest houses, granny units and in-law quarters may be eligible

- Manufactured housing is permitted

- Condominiums must meet the guidelines of the first mortgage*

*In the case of conflicting guidelines, the lender must follow the more restrictive.

Terms of the Loan

The term of the Shared Appreciation Loan matches the term of the CalHFA first mortgage

not to exceed thirty (30) years. Payments on the Shared Appreciation Loan are deferred

for the life of the first loan.

Repayment of the principal and any share of the appreciation on the Shared Appreciation

Loan shall be due and payable at the earliest of the following events:

• Transfer of title

• Sale of the property

• Payoff of the first loan

• Payoff of the subordinate loan principal balance

• Refinance of the first loan – see Refinance and Re-subordination section

• The formal filing and recording of a Notice of Default (unless rescinded)

This loan is not assumable.

Shared Appreciation Loan Terms

At the time of sale, refinance, payoff or transfer of first mortgage the homeowner must pay

back the original loan amount plus any shared appreciation percentage identified below.

Who The California Dream For All Shared Appreciation Loan May Work For

This program may not be good for everyone so you want to make sure it fits with the short term and long term plans. This may work for you in:

- You don’t have 20% to buy a home (obviously)

- You plan on living in the home long term.

- You are fine with the monthly payment at the current interest rate and are ok with not refinancing during the lifetime of the loan.

Who The California Dream For All Shared Appreciation Loan May Not Work For

One key thing to remember when you sell your home their are fees that come with it that may eat away at your equity. You want to make sure you work with your agent or lender on the cost needed to sell your home and at what home value it would make since for you to sell your home when using this program. This way you can make sure you have enough to pay the required amount borrowed back to the DFA and walk away with some equity of your own.

- Those who want to sell the home after living in it for only a few years. You may risk not having any equity in the home and having to pay back the borrowed amount from your own pocket.

- You aren’t ok with the currently interest rate and the monthly payment is too high

How To Apply

How do I apply for this loan program?

Since CalHFA is not a direct lender, our mortgage products are offered through private loan officers who have been approved & trained by our Agency. These loan officers can help you find out more about CalHFA’s programs and guide you through the home buying process.

Visit the Find a Loan Officer tab, to contact a loan officer in your area.

What documents should I have ready when contacting a loan officer?

When initially contacting a loan officer, you may want to have this list of documents and information available to help answer questions that they will ask you:

- Pay stubs

- Bank statements

- Employment history

- Previous tax returns

Homebuyer Education Requirement

CalHFA firmly believes that homebuyer education and counseling is critical to the success and happiness of a homeowner, and requires homebuyer education and counseling for first-time homebuyers using a CalHFA program.

Who has to take this Homebuyer Education and Counseling course?

Only one occupying first-time borrower on each loan transaction.

How do I take this education and counseling course?

- ONLINE: eHome’s eight-hour Homebuyer Education and Counseling course is the only online course accepted by CalHFA. (fee: $99) Other online courses like Frameworks and HomeView are not acceptable because they do not provide a one-hour, 1-on-1 counseling follow-up session.

- IN-PERSON or VIRTUAL: Live Homebuyer Education and Counseling in-person or virtually though NeighborWorks America or any HUD-Approved Housing Counseling Agency

(fee: varies by agency)

How do I take the additional California Dream For All education?

- ONLINE: This education is free and online only. Visit calhfadreamforall.com to get signed up and take the course.

For more information and details on this program feel free to reach out to me at James.Daniel@exprealty.com. I would love to connect you with some great lenders as well who can share more about this program.

You can also check out these sites to get more information from CalHFA.

- https://www.calhfa.ca.gov/dream/index.htm

- https://www.calhfa.ca.gov/homeownership/programs/loans-cadfa.pdf

I hope this information about the California Dream For All Shared Appreciation Loan anyone looking to get into their first home this year!

For more blogs to help you buy or sell your home check out this link: https://jdanielrealestate.com/category/blogs/

Hi, there!

Whether you don't know where to start or have tried to sell or rent your home in the past and it just didn't work out. I'm here to help!

Let's Chat!

Contact

james.daniel@exprealty.com

Buy

My Listings

Sell

All Blogs

schedule your free consultation