… and a few suggestions on how to make it work for you!

Should You Buy a Home in San Pedro, CA in 2024?

Deciding whether to buy a home in San Pedro, CA in 2024 can be a challenging decision. The real estate market has its ups and downs, and it’s essential to weigh the pros and cons before making such a significant investment. Let’s explore the advantages and disadvantages of buying a home in San Pedro, CA, and then look at some strategies to make your home purchase more feasible.

Pros of Buying a Home in San Pedro, CA in 2024

1. Growing Property Values San Pedro is experiencing growth and development, which often leads to an increase in property values. Buying a home in San Pedro now can be a smart investment as property values continue to appreciate over time. Just in the past twelve months single family, condos, apartments and townhomes have seen a value increase of 8.9%. In 2025 San Pedro will be opening the new West Harbor ( was know as Port’s O Call). This will 42 arces of food, drinks, nightlife and entertainment, and a place to be outdoors, recreate and bring your whole family (including the dog). This new establishment is almost certain to increase home values which could be a great reason to buy or invest in San Pedro.

Lets take a look how the grow breaks down by each home type:

Single Family Homes:

Townhomes/Condo/Apts:

Multifamily:

2. Tax Benefits Homeownership comes with various tax benefits, including deductions on mortgage interest and property taxes. I AM NOT A CPA. I repeat I AM NOT A CPA. Please talk with your CPA about these tax benefits to learn more but these can result in substantial savings come tax season.

3. Stability and Personalization Owning a home provides stability and the freedom to personalize your living space. Unlike renting, you can make changes and upgrades to suit your style and needs. I am not trying to say renting is bad and it some cases it may make more sense to stay renting. I am talking to those who want to get out of their situation or can afford to buy a home and are on the fence. You never know when your landlord may want to sell or use the home for a different type of rental at the end of you lease. Not to mention raise the rent!

4. Building Equity Equity is the difference between the market value of your home and the outstanding balance on your mortgage. Essentially, it’s the portion of your home that you truly own. Building equity in a home is one of the key financial benefits of homeownership. Every mortgage payment you make helps build equity in your home. When you put money down for a downpayment most of the time it is immediately turned into equity. Year over Year appreciation will turn into equity. Key home improvements will also lead to equity. Over time, this equity can become a valuable financial asset.

Cons of Buying a Home in San Pedro, CA in 2024

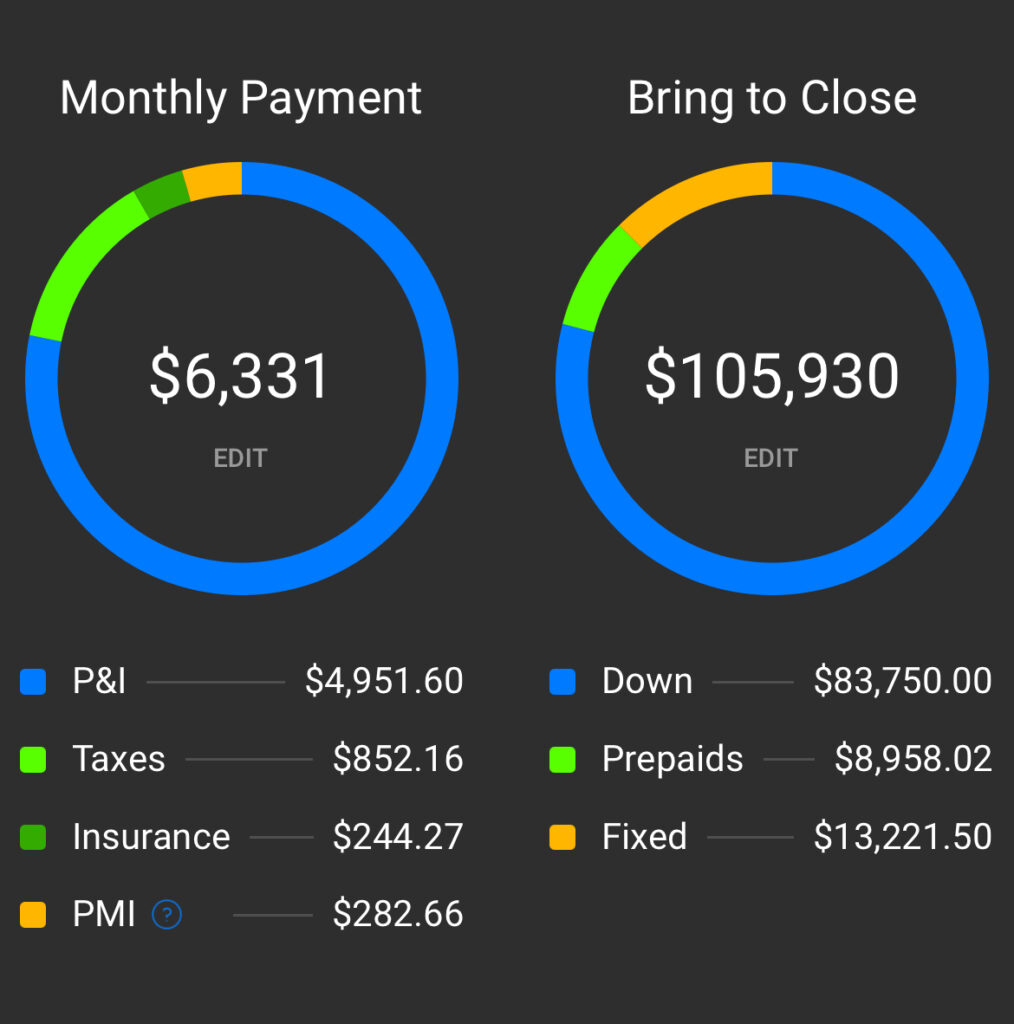

1. High Home Prices As we saw above the demand for homes in San Pedro outpacing supply, home prices remain high. According to Redfin the median sales price in the US is $442,525 in June 2024. In California it was $858,600. In the month of June San Pedro was just below the CA median at $837,500. Here is what that would look like when buying a home with 10% down and a interest rate around 6.8%:

This can make it challenging to find affordable options within your budget.

2. Rising Interest Rates Interest rates have been on the rise, leading to higher monthly mortgage payments and overall costs which you can again see in the image to the left.This is a crucial factor to consider when budgeting for a home purchase.

3. Upfront Costs The initial costs of buying a home in San Pedro, including the down payment, closing costs, and moving expenses, can be substantial. From our example to the left you can see that a putting 10% down on a home costing $837,500 will need $105,930 to bring to close. These expenses require significant savings and financial planning.

4. Maintenance and Repairs Homeownership comes with the responsibility of maintenance and repairs. These unexpected costs can add up over time and should be factored into your budget. This can include plumbing issues, yard work, preventive maintenance, electrical , HVAC and the list goes on. It may be smart to save a select amount each month as well as make sure you have a home warranty plan that fits for your home.

Making Home Buying Work for You in 2024

Despite the challenges, there are ways to make buying a home in San Pedro, CA more manageable. You may also be fine with the monthly payment on a single family home and thats great. regardless you need to always focus on a monthly mortgage payment you can afford. This article is for those of you that are having a tough time wrapping you head about why to buy a home in 2024, ways to make buying a home cheaper, or maybe those looking to get started on their investment journey. Here are some strategies to consider:

1. Buying a Condo Condos can be more affordable than single-family homes and often come with lower maintenance responsibilities. They are a great option for first-time buyers or those looking for a more manageable investment. The median sold price for a single family home in June 2024 was $964,110. For a condo the s median sold price for the month was $675,000. This cost difference can help you get into a home now and then trade up to a single family home , if that is your goal, when the time if right. Just get in the real estate game!

2. House Hacking with Roommates House hacking involves buying a property and renting out rooms to help cover your mortgage payments. This strategy can make homeownership more affordable and help you build equity faster.

My first home ( and current home ) is a condo and I started off renting out rooms on airbnb. Yes, I did live with strangers from time to time but I didn’t have to have full time roommates. That was just my preference but you can also potentially rent a room month to month to say travel nurses or even long term to friends ( or strangers).

Lets looks at the numbers:

If I were to buy a home for $800,000 and had a payment of $6,011. This is assuming we put 10% down and have a interest rate of 6.8%. If I was able to rent a room for say $1,200-$1,500 that would decrease my payment to $4,511- $4,811. Now image if it was a 3 bed room place charging $1,300 for 2 rooms while you live in one that would cut your monthly payment to $3,411. These are numbers for long term rentals and can be higher with a furnished short term or mid term rental. That is a huge difference and not to mention the potential of your mortgage going lower when you refinance to a lower rate.

3. Buying a Multifamily Home and Renting Out Units San pedro has a a variety of different types of multifamily house. The types of multifamily I am referring to is 2-4 units homes in which 59 where sold in San Pedro in 2023.

With these type of multifamily may also be able to use a FHA to buy the property which will allow you to put 3.5% down or conventional loan with a lower downpayment since you will be living in the home. Similar to the house hacking example above. Purchasing a multifamily property allows you to live in one unit while renting out the others. The rental income can help offset your mortgage payments and provide additional financial stability.

Conclusion

Buying a home in San Pedro, CA in 2024 has its pros and cons. While high home prices and rising interest rates present challenges, the potential for growing property values, tax benefits, and the stability of homeownership are significant advantages. By considering strategies such as buying a condo, house hacking, or investing in a multifamily home, you can make buying a home in San Pedro more feasible and work towards building a secure financial future.

If you have any questions or need personalized advice, feel free to reach out. I’m here to help you navigate the San Pedro real estate market and find the best options for your needs.

Hi, there!

Whether you don't know where to start or have tried to sell or rent your home in the past and it just didn't work out. I'm here to help!

Let's Chat!

Contact

james.daniel@exprealty.com

Buy

My Listings

Sell

All Blogs

schedule your free consultation