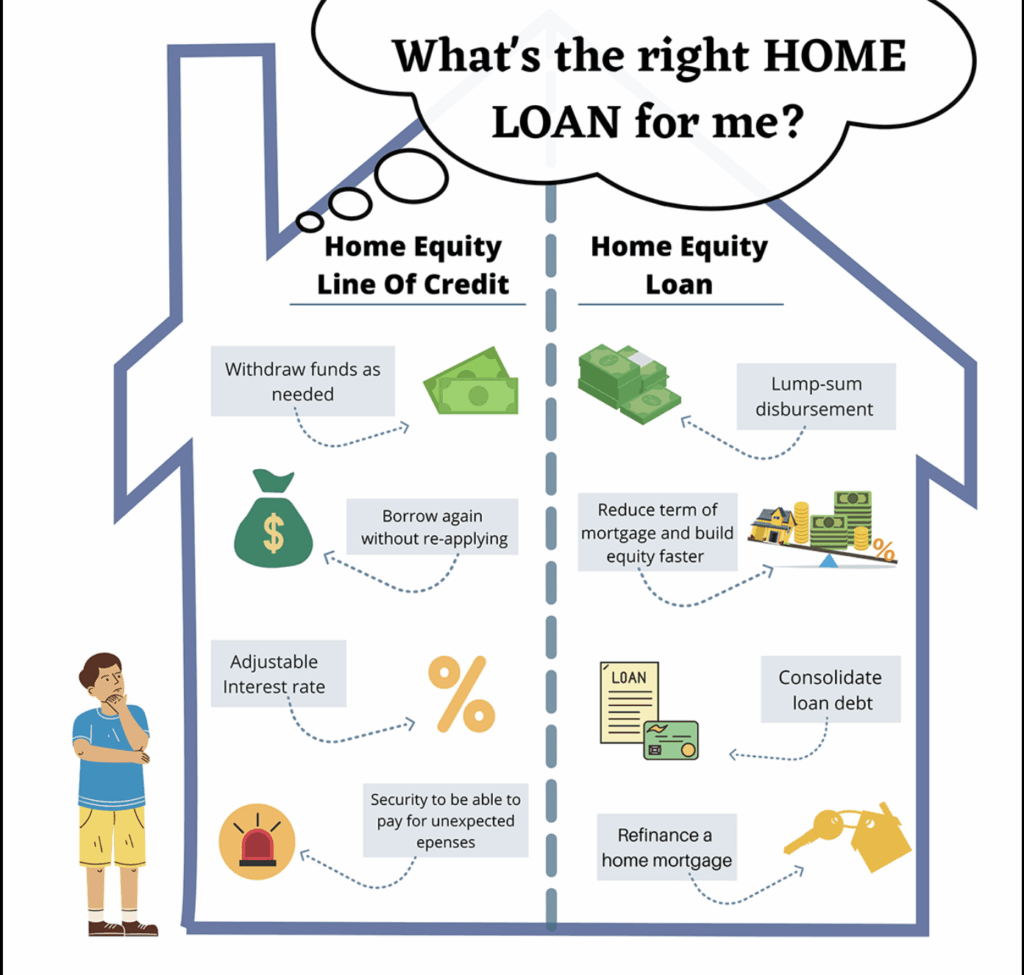

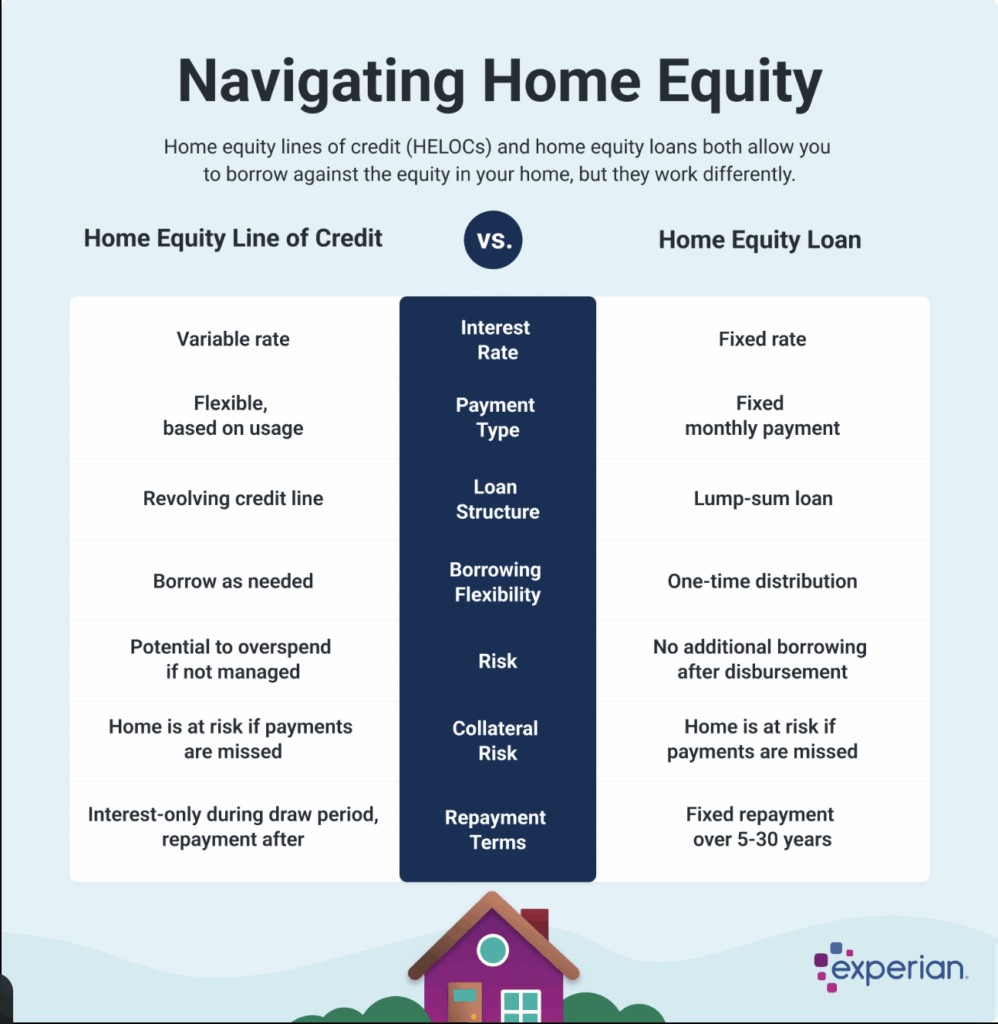

If you’re a homeowner, you may be wondering whether a home equity loan vs HELOC is the better option for accessing cash tied up in your property. While both allow you to tap into your home’s equity, they work very differently — and choosing the wrong one can create financial stress down the road.

Home equity can be a powerful tool when used strategically. But it’s not free money, and it shouldn’t be treated like a personal ATM. Understanding how each option works is the first step in deciding whether either one makes sense for your situation.

What Is a Home Equity Loan?

A home equity loan allows you to borrow a lump sum based on the equity you’ve built in your home. Equity is the difference between your home’s current value and what you still owe on your mortgage.

This type of loan is often referred to as a second mortgage and comes with:

- A fixed interest rate

- A fixed monthly payment

- A repayment term usually between 5–15 years

Home equity loans work well when you have a specific, one-time expense, such as a home renovation or consolidating high-interest debt.

What Is a HELOC?

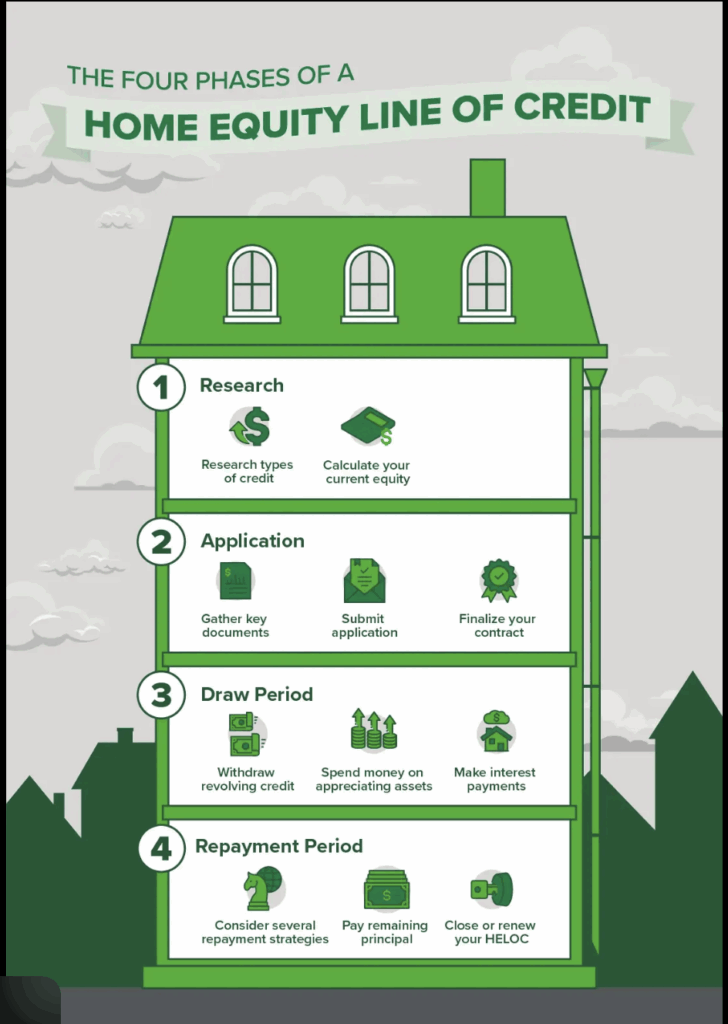

A HELOC (Home Equity Line of Credit) works more like a credit card secured by your home. You’re approved for a credit limit and can borrow from it as needed during a set draw period.

Key features include:

- Variable interest rates

- Flexible access to funds

- Interest paid only on what you use

A HELOC can be useful for ongoing or phased projects, but the variable rate means payments can increase over time.

Home Equity Loan vs HELOC: Pros and Cons

Advantages

- Lower interest rates than most credit cards

- Funds can be used for many purposes

- Interest may be tax-deductible (check with a CPA)

Disadvantages

- Your home is the collateral

- Payments must be managed carefully

- Using equity for lifestyle spending can be risky

If you can’t repay the loan, you risk losing your home which is why intent and planning matter.

When Using Home Equity Makes Sense

Using a home equity loan vs HELOC can make sense when funds are used for:

- Home improvements that add value

- Paying off high-interest debt

- Major planned expenses with long-term benefits

It usually does not make sense for vacations, shopping, or everyday spending.

How I Can Help

Before deciding between a home equity loan vs HELOC, it’s important to understand how much equity you may actually have and how your local market impacts your options. Online estimates can be off — especially in coastal Southern California where values can vary street by street.

I can help you by:

- Estimating your home’s current market value

- Helping you understand how much usable equity you may have

- Talking through whether a home equity loan or HELOC even makes sense based on your goals

- Connecting you with trusted lenders if you decide to explore your options further

👉 Find out how much your home may be worth

(Once you know your value, it’s much easier to estimate how much equity you may be able to use.)

For financial and tax implications, you should also speak with:

- A trusted lender

- A financial advisor

- A CPA

Have Questions? Let’s Talk It Through

If you’re still unsure whether a home equity loan vs HELOC is the right move, feel free to reach out. Sometimes the right decision is using equity and sometimes the smarter move is waiting. My goal is to help you understand your options so you can make the best choice for your situation.

James Daniel III

Real Estate Agent | DRE #02164911

📞 Phone: (562) 286-1735

📧 Email: james.daniel@exprealty.com

🌐 Website: https://jdanielrealestate.com

No pressure just honest guidance to help you move forward with confidence.

Hi, there!

Whether you don't know where to start or have tried to sell or rent your home in the past and it just didn't work out. I'm here to help!

Let's Chat!

Contact

james.daniel@exprealty.com

Buy

My Listings

Sell

All Blogs

schedule your free consultation